Amortization 101 - #2 - Your Friendly Neighborhood Bank Isn't So Friendly

/This is part 2 of a 3 part series

Amortization 101 - #1 - Where Does Your Interest Lie?

Amortization 101 - #3 - The Greatest Trick Ever Pulled

This post may contain affiliate links. Learn more by reading my disclosure.

At the end of my last post, I asked the question:

If so much less interest is paid on a 15-year term versus a 30-year, why would the banks ever encourage you to take out that loan?

Let’s compare two loans, all things being equal except the term.

(click the links to download the pdf's of the amortization schedules)

$200,000 initial loan @ 4.5% interest

(Please note - I realize that you will normally get a better interest rate for a shorter term loan, but for this discussion we need to control all variables except one.)

On a 30 year loan, the total interest paid will be $164,813.42.

On a 15 year loan, the total interest paid will be $75,397.58.

That’s a difference of $89,415.85.

You would think the banks would hide a 15-year loan from consumers, wouldn’t you? Wouldn't they prefer you pay that huge interest amount on the thirty year loan?

Why don’t they?

Moving On Up

(sung to the theme of The Jeffersons)

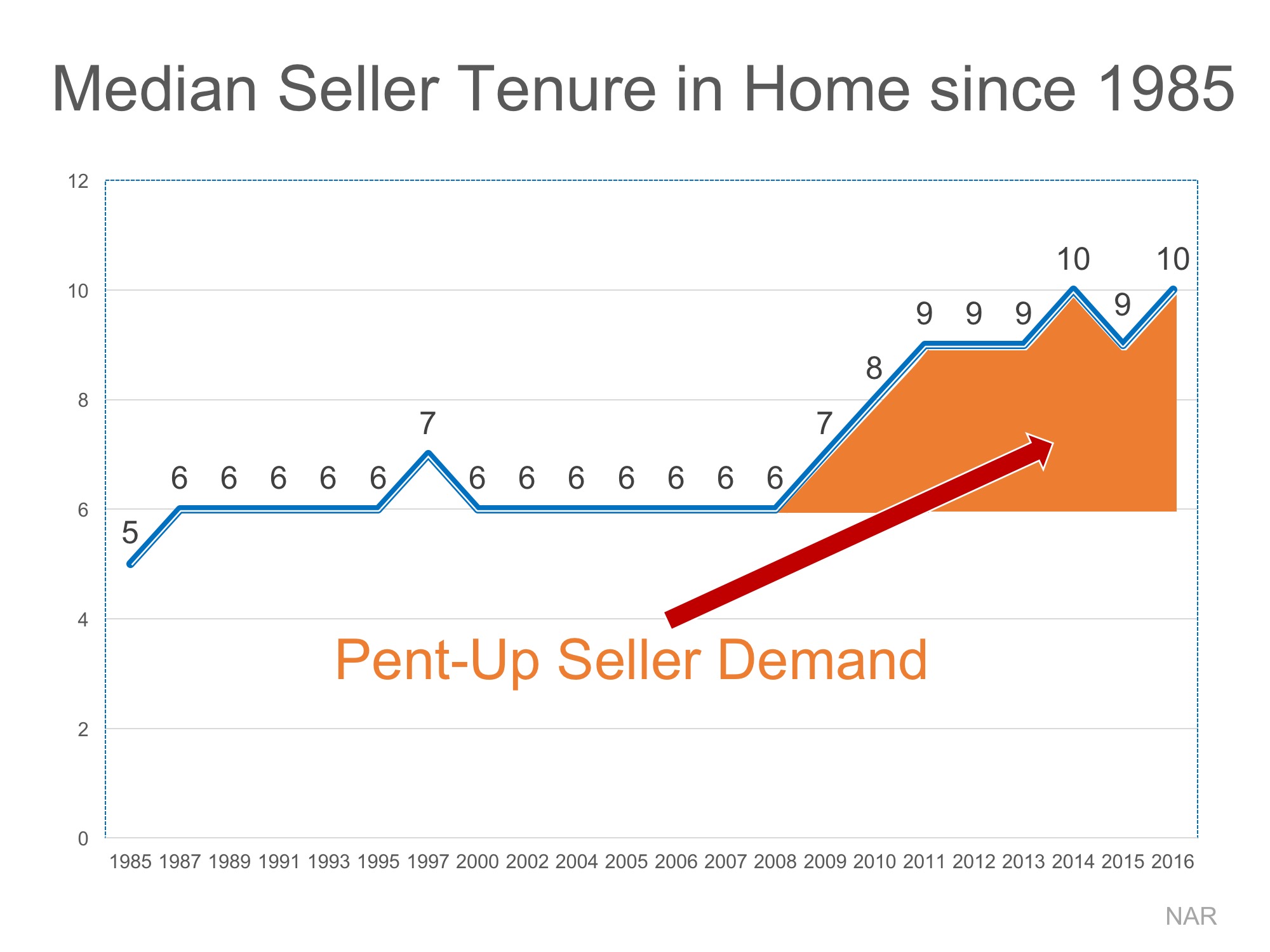

According to the National Association of Realtors, for over twenty years ('85-08), the median length of home ownership prior to selling was six years. Six years!

If you need a reminder, a median point is the exact middle of a data set. Half the numbers in the set are above that point while have are below it.

After the Great Recession, the median length of home ownership prior to selling has steadily climbed to the amazing rate of ten years! Again, half the data points are below that and have are above.

Okay, so what? How does this affect us?

Like I said in my previous article, the amortization schedule is an incredibly powerful tool (both for us and against us).

Let’s consider the two loans above and assume they are both sold at the exact median point shown for 2016: ten years (month 120).

On the 30 year loan, $81,783.34 of interest was collected by the 120th month. That’s 50% of the expected interest. In 1/3 of the loan term!

On the 15 year loan, $65,665.92 of interest was collected by the 120th month. That’s 87% of the expected interest. In 2/3 of the loan term!

If you sell your home and move on, the bank gets its remaining principal back immediately and they can re-lend it. The bank wins!

If you pay your pay your loan all the way to term, the bank wins!

It doesn't matter if you get a better rate on the shorter term loan. Do you see that? The banks really don't care if it's 15 years or 30 years. Most people never even come close to a full term. They just want you to take out a loan!

If you do that, then no matter what, the bank wins.

Although...

There is a point where the bank starts to not win as much. The longer the bank's money sits tied up in your loan, the less valuable your loan is to them. In other words, they don’t want you to carry your loan to term.

Once your loan passes the point of equilibrium (where you’re making larger principal payments than interest payments), your loan has less value to them.

There are two sides to every coin. Once it gets positive for you, it becomes negative for them.

They are watching your balance and how it affects their balance sheet.

That’s when they really start encouraging you to refinance. They start telling you it’s time for a home project or to take the vacation of a lifetime.

Don’t do it!

Falling into The Trap

Ack! You fell for it.

After seven years of paying on your loan, you decide you should refinance your previous 30-year loan and take it down to fifteen years.

You’re smart so you're only going to refinance the exact loan amount remaining. You don’t want to go further in debt.

Guess what happens when you refinance? There are new charges, points, and origination fees! You will refinance for MORE than what you had remaining on your balance. It will happen. There is no way around it.

You know what else you’ve done?

You’ve given the bank the opportunity to reset the amortization schedule and front load the interest again! They still expect you to sell your house before you get out of the fat part of the amortization schedule.

It’s Time to Flip The Script

How can you work the amortization schedule to your advantage?

It’s time to think like the bank. They always want you at the front of the amortization schedule, right?

After you’ve been there awhile, what did they offer you? An opportunity to refinance. They want to sell you on the idea of paying your home off quickly with a 15-year mortgage or the opportunity to “unlock the equity in your home.” The latter is priceless. That’s essentially treating your home like an ATM.

Either way, the bank wants you to return to beginning of the amortization schedule.

As I said earlier, there are two sides to every coin. If they want you at the front of the schedule, you need to get to the back, or at least the mid-point.

How do you do that? Immediately, start pushing your way to the later stages.

Now, you can make small extra monthly payments of $100 to help speed up your loan. In fact, the bank even encourages you to do it.

Wait. The bank encourages it? Why would they do that? Because it doesn’t rapidly push you down the amortization schedule. It’s small, baby steps. Take a look at what happens with $100 steps monthly for thirty years.

You pay an extra $100 a month towards principal ($36,000) and total interest paid falls from $164,813 to $133,067. That's a savings of $31,746 in interest and wipes off 60 months or 5 years. Not bad!

However, we talked earlier about the median length of home ownership is currently ten years (previously six!). “Come on, big hitter, send us $100 a month,” the bank says with a snicker. That’s not going to do anything to that amortization schedule.

Try again.

If you want to make big gains, you’re going to have to drop significant dollars and drop them with some frequency, especially early in the amortization schedule when the interest is high.

Let's imagine some really good fortune comes your way and a book deal lands in your lap. You get a $20,000 advancement on future royalties. You plunk that down on the property at the end of year 2. What happens?

That $20,000 will knock the total interest paid from $164,813 to $122,177. That's a savings of $42,636 and 61 months of actual payments.

There's $16,000 of difference in the extra amount you pay to the bank between to the two scenarios, but the one that costs you more actually gets you less results.

Why? It's compound interest. It's been talked about in how it works for you in investing. Guess what? It's inside your amortization schedule and it's screwing you on a monthly basis.

You won't beat the amortization schedule without getting bloody. If want to get in the ring, you're going to get hit. It's going to take concentrated effort to get it paid down. You're going to have to make sacrifices. However, the first thing you need to know is the rules of the game. All the rules are contained within the amortization schedule.

Load up the amortization schedule you created from the first article and see what happens. It’s a fun experiment and will change how you think about your own home and investment loans.

Always remember, this schedule is being used against you. Start playing with it to see where you are on a monthly basis and you can shift the game slightly. It will never be fully in your favor, but you were the one asking for the loan, right?

Don't take me the wrong way. I’m not anti-banks or anti-mortgages. We need leverage. I'm using it to acquire new properties every year.

However, what is frustrating is that so many homeowners and investors have no idea what's going on inside their own amortization schedules.

A New Way to Look at The Cost of Selling Your Home

You’ve lived in your house for ten years and you’ve got the itch to move somewhere new. You’ve done some remodeling over the years. You’ve upgraded both bathrooms, completely remodeled the kitchen, you’ve built-out the basement to add another room to the house. Your house looks fantastic and you’ve added value to it. This is the American Dream.

Being the smart, inquisitive person type you are, you grab a pad of paper and do some quick arithmetic to see how you’ll come out in the end.

Original purchase price: $250,000

Remodel costs: + $50,000

Total investment: $300,000

Appraised Value at time of Sale: $350,000

Sale costs: Estimate 9% or - $31,500

Total Sale Proceeds $318,500

When you purchased the home you put down 20% ($50,000) and financed $200,000 at 4.5% for 30 years. (from our earlier exercise)

Remaining Loan Balance: $160,179

Actual profit at time of sale: $158,321

Nice job! Appreciation and pay down really worked for you.

You lean back, put your hands behind your head and smile. This is how you get ahead in life.

Except you’ve already paid $81,783 worth of interest over that same time to the bank.

You are only truly profiting $76,538 which is slightly more than the value of your remodel costs.

You lean forward and re-look at your numbers. What the hell happened?

Interest happened and you failed to account for it.

Imagine how bloody this would have been if you hadn't put down 20% at the outset?

We never account for accumulated interest when we sell a home or investment property. It's that hidden cost that everyone ignores. Why?

In the next article … The Greatest Trick Ever Pulled.